Understanding property taxes in Marbella

When considering a property purchase in the vibrant city of Marbella, understanding the local property taxes is crucial. One of the primary taxes is the Impuesto sobre Bienes Inmuebles (IBI), or Property Tax. This tax is imposed annually by the local town hall and is based on the cadastral value of the property. The rates typically range between 0.3% and 1.3% of this value, varying by municipality. Securing a copy of the latest IBI receipt from the seller is a wise move to ascertain the precise amount payable.

Another significant tax to consider is the Plusvalía, a Capital Gains Tax on property that is levied by the local authorities. This tax is calculated on the increase in the land value from the time the property was purchased to the time of its sale. Factors such as the property’s location and the duration of ownership can significantly influence the rate. Additionally, there may be other local taxes to consider, such as the Rubbish Tax, which covers waste management services.

Legal fees and notary costs

Engaging the services of a lawyer during the home buying process in Marbella Town Centre is not only advisable but essential. Legal fees usually account for approximately 1% of the property purchase price. A lawyer ensures that all legal aspects of the transaction are thoroughly vetted, providing peace of mind to buyers.

Notary fees are another consideration, typically amounting to around 1.5% of the purchase price. The notary plays a vital role in certifying the property deeds and ensuring all taxes are paid. While the law stipulates that 80% of the notary fees are the seller’s responsibility, it is common practice for buyers to cover the entire amount. Registering the property at the Land Registry is the final step, securing your legal title.

Additional costs to consider

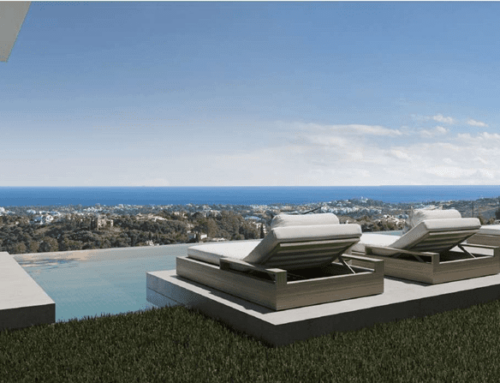

Beyond taxes and legal fees, several other costs can impact the long-term affordability of owning a home in Marbella. Community fees are common, especially for properties within urbanisations or condominiums. These fees contribute to the maintenance of common areas and facilities, such as swimming pools and gardens. Obtaining a certificate from the community of owners, confirming that these fees are up to date, is necessary at the time of purchase.

Maintenance costs and insurance are additional expenses that should not be overlooked. Regular maintenance ensures the property remains in excellent condition, while homeowners insurance provides protection against unforeseen events. Considering these factors is crucial for prospective buyers, as they can significantly influence the overall cost of Marbella homeownership.

At MPM, we are committed to making your dream of owning a beautiful home in the Marbella area a reality. Our dedicated buyer consultants are here to guide you every step of the way, ensuring that you find the perfect property that meets your unique preferences and needs. Ready to discover the key to your dream home? Contact our expert team today and let us help you unlock the doors to your future.