Understanding the Marbella real estate market

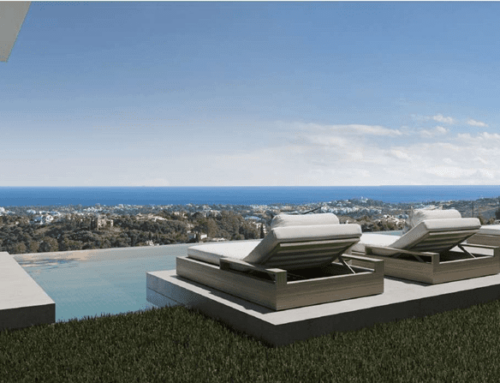

The Marbella real estate market continues to be a magnet for foreign buyers, drawn by its sunny climate, luxurious lifestyle, and stunning coastal views. In recent years, Marbella has seen a surge in demand, particularly for luxury properties, making it one of Spain’s most sought-after destinations. The market has experienced a steady increase in property values, with prime locations commanding prices that reflect the area’s exclusivity and desirability.

Marbella’s appeal to international buyers stems from its blend of modern amenities and traditional charm. The city’s infrastructure supports a high-quality lifestyle, with numerous golf courses, fine dining establishments, and exclusive shopping venues. Additionally, the rise in digital nomads and remote workers has further fueled demand, making buying property in Marbella an attractive investment. For those seeking a slice of paradise on the Costa del Sol, Marbella offers a unique combination of luxury, lifestyle, and investment potential.

Eligibility criteria for foreigners

For foreigners looking to finance a property purchase in Marbella, understanding the eligibility criteria is crucial. Generally, non-residents must obtain a NIE (Foreigner’s Identification Number), which is essential for any legal or financial transactions in Spain. This is a straightforward process that can be initiated at a Spanish consulate in your home country or locally in Spain.

In addition to the NIE, financial stability is a key requirement. Lenders will typically require proof of income and financial assets to assess eligibility. It’s important to note that while you don’t need to be a resident of Spain to purchase property, securing financing may involve meeting specific financial criteria, such as demonstrating the ability to make a substantial down payment, often around 30% of the property’s value.

Mortgage options available in Spain

Foreigners have several mortgage options available when looking to finance a property in Spain. Both local Spanish banks and international banks offer mortgages to non-residents, although terms and conditions may vary. Spanish banks tend to offer competitive interest rates, often lower than their international counterparts, but may require more documentation to assess risk.

Mortgages are typically available with fixed or variable interest rates, with terms ranging from 5 to 30 years. It’s advisable to compare offers from different lenders to secure the best terms. Consulting with a real estate expert or a buyer’s consultant can be beneficial in navigating the complexities of mortgage options and identifying the most suitable choice for your financial situation.

Legal considerations and paperwork

Purchasing property in Marbella involves several legal considerations and paperwork that must be meticulously handled to ensure a smooth transaction. One of the first steps is securing the NIE, as previously mentioned. Additionally, the purchase process typically involves a reservation contract and a private purchase contract, where the buyer pays a deposit to secure the property.

The final step in the property purchase is the signing of the public deed before a notary, which formalizes the transaction. This stage requires thorough due diligence, including verifying the property’s legal status and ensuring there are no outstanding debts or encumbrances. Engaging a knowledgeable real estate consultant can help streamline these processes, ensuring compliance with all legal requirements.

Tips for securing financing

Securing financing as a foreigner can be a daunting process, but with the right preparation, it’s entirely feasible. One of the first steps is to ensure your credit score is in good standing, as this will significantly impact your ability to obtain favorable mortgage terms. Gathering comprehensive financial documentation, including income statements, tax returns, and bank statements, will also aid in the process.

Working with a financial advisor or a real estate consultant can provide valuable insights into the Spanish mortgage market and help you present a strong case to lenders. Additionally, understanding the specifics of currency exchange and utilizing services that offer competitive rates can help maximize your purchasing power when transferring funds internationally.

Role of a buyer consultant

A buyer consultant, such as MPM Real Estate Buyer Consultants Marbella, plays a crucial role in guiding foreigners through the property purchasing process. From identifying properties that meet your criteria to negotiating the best terms, a consultant provides invaluable support at every stage.

These experts help navigate the local real estate landscape, leveraging their extensive network and market knowledge to find exclusive properties, including those not publicly listed. They also manage the legal and financial aspects of the purchase, ensuring a seamless experience from start to finish.

Common challenges and solutions

Foreigners may face several challenges when financing a property purchase in Marbella, including navigating different legal systems, language barriers, and understanding local market dynamics. However, these hurdles can be overcome with careful planning and the right support.

One effective strategy is to work with bilingual professionals who can bridge language gaps and provide clear communication throughout the process. Additionally, staying informed about market trends and legal requirements can help avoid potential pitfalls. By leveraging the expertise of seasoned consultants and advisors, you can confidently navigate the complexities of the Marbella real estate market.

At MPM, we are committed to making your dream of owning a beautiful home in the Marbella area a reality. Our dedicated buyer consultants are here to guide you every step of the way, ensuring that you find the perfect property that meets your unique preferences and needs. Ready to discover the key to your dream home? Contact our expert team today and let us help you unlock the doors to your future.