Understanding the Spanish property tax system

When purchasing real estate in Spain, it’s essential to understand the Spanish property tax system to ensure compliance and avoid unexpected costs. This system comprises various taxes that apply to both the transaction itself and ongoing property ownership. For foreign buyers, navigating these taxes can be complex, but with the right knowledge, you can manage them effectively.

The Spanish property tax system primarily includes taxes such as Transfer Tax, Value Added Tax (VAT), and Stamp Duty, which are applicable during property transactions. Additionally, ongoing taxes like the Impuesto sobre Bienes Inmuebles (IBI) and potential wealth taxes must be considered. Each of these taxes has its own set of rules and rates, which can vary depending on factors such as property location, type, and the buyer’s residency status.

Key taxes foreign buyers should be aware of

Foreign buyers looking to invest in real estate in Spain must be aware of several key taxes. The Transfer Tax, also known as Impuesto de Transmisiones Patrimoniales (ITP), is levied on the purchase of resale properties. The standard rate is 7%, but this can vary by region. For newly built properties, VAT is charged at 10%, plus an additional 1.5% Stamp Duty.

It is important to note that legal and notary fees, along with registration costs, typically add about 10% to the purchase price of a property. Understanding these costs is crucial for budgeting accurately and ensuring a smooth property purchase process.

Annual property taxes and obligations

Once you’ve acquired a property in Spain, you’ll need to consider annual property taxes and obligations. The IBI, or Real Estate Tax, is paid annually and is calculated based on the cadastral value of the property. This rate can vary between 0.3% and 1.3%, depending on the municipality.

In addition, non-resident property owners may be subject to a Non-Resident Income Tax, which is calculated based on the imputed rental income of the property. This is typically 1.1% or 2% of the cadastral value, with tax rates of 19% for EU residents and 24% for others. Wealth tax, although currently subsidised in Andalusia, may also apply to individuals with significant assets.

Tax benefits and exemptions for foreign buyers

Despite the various taxes associated with owning property in Spain, there are potential tax benefits and exemptions available to foreign buyers. For instance, if the property is intended for your primary residence, you might qualify for reduced rates on the Transfer Tax, especially if you meet certain criteria such as age or residency status.

Additionally, some regions offer incentives and deductions for energy-efficient properties or those located in areas with depopulation challenges. Understanding how to qualify for these exemptions can lead to significant savings and make the investment more attractive.

Legal considerations and compliance

Ensuring compliance with Spanish property taxes is vital to avoid legal issues. It’s essential to familiarise yourself with the legal requirements surrounding property ownership and taxation in Spain. This includes registering the property correctly, paying taxes on time, and understanding your obligations as a foreign property owner.

Foreign buyers should also be aware of the implications of owning property through a corporate structure, particularly if the company is based in a tax haven. Such ownership structures can attract additional taxes and require careful management to remain compliant with Spanish tax laws.

Seeking professional advice

Navigating the complexities of Spanish property taxes can be challenging, especially for foreign buyers unfamiliar with local regulations. Consulting with tax professionals and real estate experts is crucial. These professionals can provide tailored advice based on your specific circumstances and help you maximise any available tax benefits.

At MPM Real Estate Buyer Consultants Marbella, we understand the intricacies of the Spanish property market and taxation. Our experienced team is dedicated to guiding you through every step of the purchase process, ensuring that you make informed decisions and comply with all legal requirements.

Common pitfalls and how to avoid them

Foreign buyers often encounter common pitfalls when dealing with Spanish property taxes, such as underestimating the total cost of ownership or failing to account for annual tax obligations. These mistakes can lead to significant financial and legal issues if not addressed promptly.

To avoid these pitfalls, it’s important to conduct thorough research and seek expert guidance before purchasing property. Understanding the full scope of taxes, fees, and legal requirements will help you make informed decisions and prevent costly errors. Working with seasoned professionals can also provide peace of mind and ensure a smooth transaction.

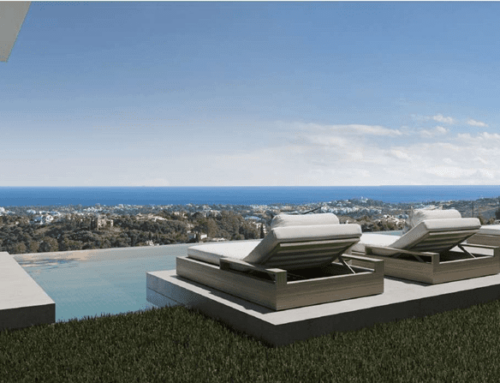

At MPM, we are committed to making your dream of owning a beautiful home in the Marbella area a reality. Our dedicated buyer consultants are here to guide you every step of the way, ensuring that you find the perfect property that meets your unique preferences and needs. Ready to discover the key to your dream home? Contact our expert team today and let us help you unlock the doors to your future.