Introduction to Marbella’s luxury real estate market

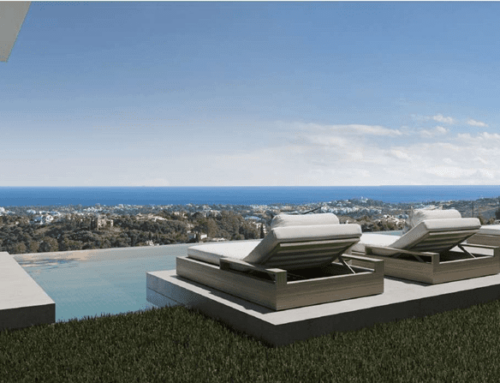

Nestled along the sun-drenched shores of the Costa del Sol, Marbella is a vibrant city that has long been synonymous with luxury living. Known for its stunning beaches, world-class golf courses, and exquisite dining experiences, Marbella offers a unique blend of traditional Spanish charm and modern opulence. It’s no wonder that this picturesque location has become a hotspot for those seeking to invest in luxury villas and high-end real estate.

However, before diving into the world of luxury villa ownership in this sought-after destination, it’s crucial to understand the costs involved. Owning a property in Marbella is not just about the initial purchase price—there are numerous ongoing expenses that need careful consideration. From property taxes and maintenance fees to insurance and community charges, being well-informed will help you effectively plan your budget.

Initial purchase costs and considerations

Purchasing a luxury villa in Marbella requires a significant financial commitment. The initial costs include not only the price of the property but also various taxes and fees. Buyers should be prepared for the property transfer tax, which can vary depending on the villa’s value. Additionally, legal fees, notary fees, and registration costs are typically around 10-15% of the purchase price.

It’s also essential to factor in the costs associated with securing a mortgage if needed. Mortgage fees, including valuation and arrangement fees, can add up. For those considering an investment property, understanding the market dynamics and potential rental yields is critical. Consulting with experts, like MPM Real Estate Buyer Consultants, can provide valuable insights into making a sound investment.

Understanding property taxes in Marbella

Property taxes in Marbella are a significant consideration for villa owners. The Impuesto sobre Bienes Inmuebles (IBI) is an annual property tax calculated based on the cadastral value of the property. The rates vary depending on the municipality, generally ranging from 0.3% to 1.3% of the cadastral value, which is often lower than the market value.

For non-residents, the Non-Resident Income Tax is also applicable. This is assessed on the deemed rental income of the property, even if it is not rented out. Depending on your tax residency status, the applicable rate can be 19% for EU residents or 24% for others. To navigate these complexities, it’s advisable to engage a tax professional or a knowledgeable consultant who can provide tailored advice.

Ongoing maintenance and management expenses

Maintaining a luxury villa can be costly, with expenses varying based on the property’s size, location, and amenities. Regular maintenance includes gardening, pool upkeep, and general repairs. These can average between €5,000 to €10,000 annually, depending on the villa’s specifics.

Additionally, many luxury properties are part of gated communities, which offer amenities such as security, gyms, and communal gardens. Community fees for these services can range from €2,000 to €5,000 per year. It’s crucial to factor these costs into your budget to ensure your property remains in pristine condition and retains its value.

Insurance requirements and costs

Insurance is another critical component of luxury villa ownership. A comprehensive home insurance policy is vital to protect your investment against unforeseen events such as natural disasters, theft, or damage. Premiums for luxury villas typically range from €1,000 to €3,000 annually, depending on the villa’s value, location, and specific coverage requirements.

Additionally, if you plan to rent out your villa, landlord insurance is advisable. This covers potential liabilities related to tenant issues and additional property damage. Understanding and securing the right insurance policies will provide peace of mind and financial protection for your investment.

Potential investment returns

Investing in a luxury villa in Marbella can offer substantial returns, both in terms of capital appreciation and rental income. The region’s real estate market has shown resilience and growth, attracting high-net-worth individuals and investors worldwide. Villas in prime locations, particularly those with sea views or proximity to golf courses, tend to appreciate more rapidly.

Rental yields can also be attractive, especially during the high tourist season. Many owners choose to rent their properties short-term to maximize returns. Before proceeding, it’s advisable to evaluate the market trends and potential rental income. Consulting resources like Is Buying Property in Marbella East a Good Investment? can offer valuable insights into the viability of such investments.

Conclusion: Weighing the costs and benefits

Owning a luxury villa in Marbella is a dream for many, but it’s essential to go into it with eyes wide open. The costs extend beyond the purchase price, encompassing taxes, maintenance, insurance, and other ongoing expenses. By understanding these financial obligations, you can make informed decisions and plan your budget effectively.

However, the benefits of owning a property in this stunning locale are immense—from the potential for financial gain to the lifestyle perks of living in one of Spain’s most beautiful regions. At MPM, we are committed to making your dream of owning a beautiful home in the Marbella area a reality. Our dedicated buyer agents are here to guide you every step of the way, ensuring that you find the perfect property that meets your unique preferences and needs. Contact our expert team today and let us help you unlock the doors to your future.